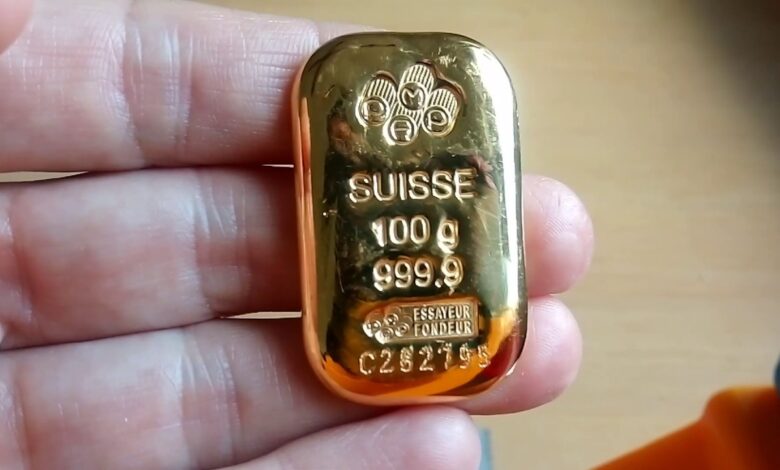

Should You Sell or Hold Your 100g Gold Bar?

Gold is one of the most trusted assets in the world. A 100g gold bar, in particular, holds significant value and is often seen as a reliable store of wealth. But deciding whether to sell it or continue holding can be a challenge, especially when markets are uncertain.

Your decision depends on several factors, personal financial needs, the current gold price, and your long-term investment goals. Timing plays a key role too, and knowing when to act can directly impact the returns you get from your gold bar.

If you’re leaning toward selling, you can sell 100g gold bar through a trusted platform that offers competitive rates and secure transactions.

Why Investors Choose to Hold Gold Bars

Many investors hold onto their gold bars as a long-term hedge against inflation and market volatility. Gold tends to retain value even when other assets fall, which makes it a dependable part of any diversified portfolio.

Physical gold like a 100g bar is also easy to store and doesn’t rely on digital systems. This appeals to those who want full control over their assets, especially during times of economic or political uncertainty. When global conditions feel unstable, holding gold can provide peace of mind.

Reasons You Might Consider Selling

While gold is valuable, there are times when selling makes sense. One of the biggest reasons is taking advantage of high prices. If the market is trading at a strong level, you might want to cash in and lock in gains.

Selling could also be a smart move if:

- You need liquidity for other investments or expenses

- You’re rebalancing your portfolio

- You believe gold prices have peaked in the short term

- You no longer wish to hold physical assets

Knowing why you bought the gold bar in the first place can help guide your decision now. If your goals have changed, selling might be more practical than continuing to hold.

Understanding Market Conditions

To make an informed choice, it’s important to follow the market closely. Gold prices are influenced by several factors, including:

- Interest rates

- Inflation

- Currency strength (especially the US dollar)

- Global political or economic events

- Central bank policies

When inflation is high or currencies weaken, gold tends to perform well. Conversely, when interest rates rise and economies strengthen, gold may cool off. Paying attention to these trends can help you decide whether it’s time to sell or hold.

Set Your Personal Financial Goals

Everyone’s situation is different. Ask yourself what role your 100g gold bar plays in your financial plan. If it’s purely an investment, the decision might come down to market performance. But if it’s part of your emergency savings or legacy planning, you might lean toward holding it longer.

Here are a few questions to consider:

- Do you need immediate cash for a major purchase or expense?

- Are you planning for retirement or future generations?

- Is your investment portfolio balanced, or is it too heavy in gold?

Clear goals make the decision easier. If your gold no longer serves its purpose, selling might be the right move.

Tax Implications of Selling Gold

Depending on where you live, selling gold could trigger capital gains tax. It’s important to understand the tax rules before you make a sale, especially if your gold bar has appreciated significantly in value.

In the UK, for example, certain gold coins are exempt from capital gains tax, but gold bars are not. Keeping records of when you purchased the bar and at what price will help you calculate any potential tax due after the sale.

If you’re unsure, consider speaking with a tax advisor or financial planner before finalising your decision.

How to Sell a 100g Gold Bar Safely

If you’ve decided to sell, choose a platform that is well-established, transparent, and offers secure delivery options. A 100g gold bar is a high-value item, so it’s important to work with a buyer that provides insured shipping, clear pricing, and fast payment.

Steps to take when selling:

- Compare current market prices and get a firm quote

- Ensure your bar is in good condition and, if possible, in original packaging

- Package it securely and use a trusted courier with insurance

- Keep proof of shipping and tracking for your records

Reputable online buyers can make the process easy and worry-free, often with same-day payment once they receive and verify your gold bar.

What If You’re Still Unsure?

If you’re torn between selling and holding, it’s okay to wait. Gold isn’t a time-sensitive asset. Unless you urgently need the money, there’s no harm in observing the market a little longer.

You could also consider selling a portion of your gold holdings. That way, you benefit from current prices while still keeping a safety net in place.

In times of uncertainty, holding onto part of your gold can offer reassurance and continued protection for your wealth.

Final Thoughts

Deciding whether to sell or hold your 100g gold bar is a personal decision that depends on your financial situation, market trends, and long-term goals. There’s no single right answer, but with the right information, you can feel confident in your choice.